Leave of Absence

To learn more about the types of leaves of absence, please refer to the Non-FMLA Medical and Personal Leave of Absence policy. Your benefits may be impacted while on a Leave of Absence — particularly if it is an unpaid leave. Review the policy for more details.

Benefit Details

Health, Dental, Vision, Disability and Life Insurance Coverage

While you are on paid leave, your insurance premiums will continue to be deducted from your paycheck.

If you go on unpaid leave, it is your responsibility to pay the premiums for your existing coverage through direct billing. Empyrean Billing Services manages direct billing administration for Vanderbilt. You will receive payment invoices directly from Billing Services. Failure to receive invoices does not relieve you of your responsibility of making timely premium payments.

Direct Billing Process

A direct billing invoice will be mailed to your home address by the direct billing administrator, Empyrean Billing Services, once you are placed in an Unpaid Leave of Absence status. While on direct bill, you will be billed on the same payroll cycle as when you are actively working. For example, if you are paid weekly and you are placed on unpaid leave in the first week of the month, you will receive your direct billing invoice the following week. You will continue to be billed weekly and premium payments will be due weekly until you return from unpaid leave. The premium billing and payment cycles will follow the same pattern for those paid biweekly and monthly. It is the responsibility of the employee to make timely payments, even if direct billing invoices are not received. Payment due dates will be noted on the invoices. If the direct billing administrator does not receive payment by the end of the grace period, also noted on the direct billing invoices, coverage will be terminated back to the last paid through date. If coverage is terminated due to non-payment while the employee is on unpaid leave, the employee will not be able to re-enroll in coverage until Open Enrollment for the following year, unless they experience a qualifying life event.

Spending Accounts

If you are on an unpaid leave and have a Flexible Spending Account (FSA), your payroll contributions will stop until you return to work. Upon return to work, the remaining FSA election will be recalculated based on remaining payrolls.

If you are on unpaid leave and have a Health Savings Account (HSA), your HSA contributions will stop until you return to an active pay status. When you return from leave, your contributions will be recalculated based on your year goal amount divided by the remaining pay periods. As you are still an employee of the University, you will receive the University HSA seed money (given in January and July). In order to receive the seed money, you must be enrolled in the University’s CDHP, HSA account via Fidelity in good standing, and be an employee on January 1 for the January seed and July 1 for the July seed.

Retirement Plan

You cannot continue to contribute to your retirement accounts during an unpaid leave. However, your existing retirement funds will remain invested as you directed.

Accrued Time Off

Accrued time off must be exhausted before an unpaid leave of absence can begin. However, if on unpaid leave due to short-term disability, you must only use enough accrued time to satisfy the applicable waiting period. Employees enrolled in only the base option of enhanced short-term disability are required to exhaust all grandfathered sick time before short-term disability starts paying. Time off accruals will stop during an unpaid leave of absence. Refer to the Non-FMLA Medical and Personal Leave of Absence policy or the short-term disability insurance webpage for more information.

Returning from Unpaid Leave

If you paid your portion of your benefits through direct billing, then your regular deductions will resume on the first pay cycle following the date you return from leave. If you return from leave in the middle of a pay period, you will still need to pay your benefit premiums for the remainder of the current pay period as noted on your last invoice through direct billing with Billing Services.

Failure to pay your premiums via direct bill will result in the termination of your benefit coverage. Any claims incurred during the time of non-payment will be denied and you will be responsible for the full cost of the expense.

FAQs

You have 30 days from the date of the qualifying life event to add a child to your insurance coverage. For a newborn, that is 30 days from the date of birth. For an adopted child, it is 30 days from the date the adoption is finalized by the courts.

Documentation is required to add your newborn or adopted child to your insurance coverage. A birth certificate, hospital record or birth, or a final copy of the court documents signed by the judge in the case of adoption must be uploaded on MyVU Benefits within 30 days of the date the life event was processed online.

In order to add your newborn or adopted child to your insurance coverage, log into MyVU Benefits and follow the steps below:

- Go to MyVU Benefits:

- Log in with your VUnetID and password

- On the left-hand side of the page, select Change Your Current Benefits

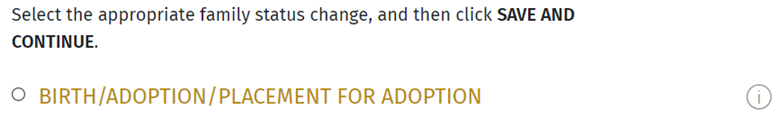

- Select your life event: from the Life Events page, Choose “Birth/Adoption/Placement for Adoption”

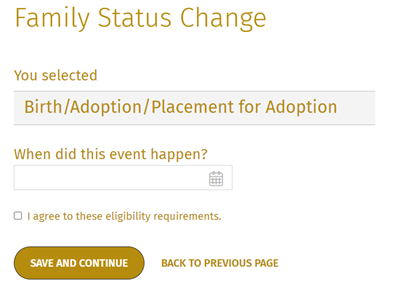

- Enter the baby’s date of birth and agree to the eligibility requirements.

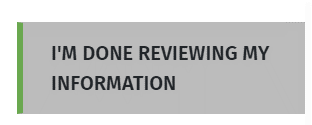

- Review your personal information and select I’m Done Reviewing My Information.

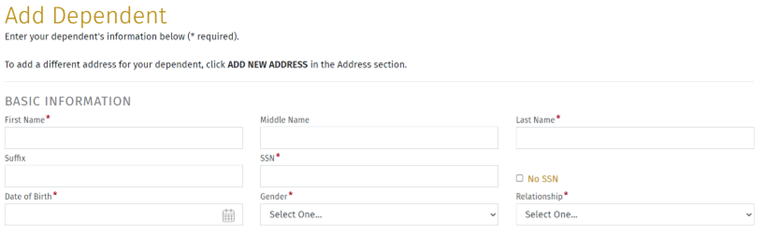

- On the My Dependents page, select Add New, then enter your child’s information and select Save Changes. Then select I’m Done with Dependents

- Click on each benefit to which you wish you add your new child. Please be sure to check the box next to your new dependent’s name at top part of the screen for each benefit you in which you wish to enroll them (medical/dental/vision). If you do not check the box next to your dependent’s name, they will not be added to your benefits.

- Go through your each of your benefits and make your selections.

- Review your elections and then click on I’m Done Selecting Benefits.

- Confirm your beneficiaries and select I’m Done with Beneficiaries.

- If you have your dependent verification documents with you (birth certificate, hospital record of birth, finalized adoption paperwork), select Upload Documentation. If you need time to gather your documentation, you have 30 days from the date you complete your life event to submit documentation.

- Click on I’m Ready to Finalize My Elections, then, once you have reviewed your elections, select Submit My Elections and click on Accept.

- Print or save a copy of your enrollment for your records.

Reminder: you have 30 days from the life event to declare the life event

You are not required to enroll your child in benefits you do not need for them at this time. You may add dependents to these benefits during future open enrollment periods.

You may submit a benefit appeal request to have the addition of your child reviewed by the Appeals Committee after the 30-day deadline has passed. All committee decisions are final. Note that it may take up to 45 days to receive a decision.

No, you do not have to have a Social Security number before adding your child to the insurance coverage. We realize that there will be some lag time between adding a dependent child and obtaining a government issued identification number.

All dependents must have a Social Security number issued by the Social Security Administration (this information is needed for claims processing purposes and to meet ACA requirements only). Your dependent information can be updated by contacting Human Resources upon receipt of the Social Security number.

Provided you are enrolled in the disability plan offered by Vanderbilt and pre-existing conditions are not a factor, you may be eligible for partial income replacement while you are away from work. Contact MetLife, Vanderbilt's disability provider, at 1.833.622.0135 to begin your claim.

You may continue your health benefits while on leave. Your portion of the premium can continue to be deducted from your paycheck as long as you remain in a paid status. In the event your leave extends into an unpaid status, you will automatically be enrolled in direct billing through Empyrean Billing Services, the authorized benefit administrator for Vanderbilt University.

Contact Information

For questions regarding leave of absence and benefits, contact People Experience.

For questions regarding direct billing, contact Empyrean by calling Customer Service at 833.874.1600, Monday through Friday, 7:00am to 7:00pm CT.