Supplemental Medical Benefits

Together with New York Life, Vanderbilt offers three supplemental medical benefits to provide you with extra protection in the event of a serious medical condition, hospitalization, or injury due to an accident. These benefits are available to partially and fully benefits-eligible employees, their spouses, and unmarried children up to the age of 26. You may enroll or disenroll from these coverages at any time, and no statement of health is required.

With each of these insurance plans, the benefit is paid directly to you so you can use it however you need. The money could be used to pay for deductibles, coinsurance, copays, or other medical expenses. You could also use it to cover your rent or mortgage, groceries, childcare, or transportation.

Prevention is the best way to avoid serious illness, so it’s important to get your annual preventive screenings. Each of these plans reward you for going to your preventive exams by paying a $50 annual benefit after you have your yearly physical, mammogram, colonoscopy, preventive dental visit, or well woman visit, among many others. You just need to visit https://myNYLGBS.com and file a claim to receive your $50 benefit. You may utilize this benefit under each plan, but no more than once per year, for a total payout of up to $150. You must submit a different preventive exam under each benefit.

Each of these benefits are also portable, meaning if you leave Vanderbilt, you may continue enrollment with New York Life by making premium payments directly.

Critical Illness insurance

Critical Illness insurance provides a lump sum cash payment if you or a covered family member is diagnosed with a serious illness such as cancer, heart attack, or stroke. The benefit is available at two levels, either $15,000 or $30,000. If you choose to enroll and have eligible dependents on file at My VU Benefits, you will be given the option to enroll your spouse and child(ren) as well. Below is a summary of the benefits. For more information, please see the plan document.

Hospital Indemnity insurance

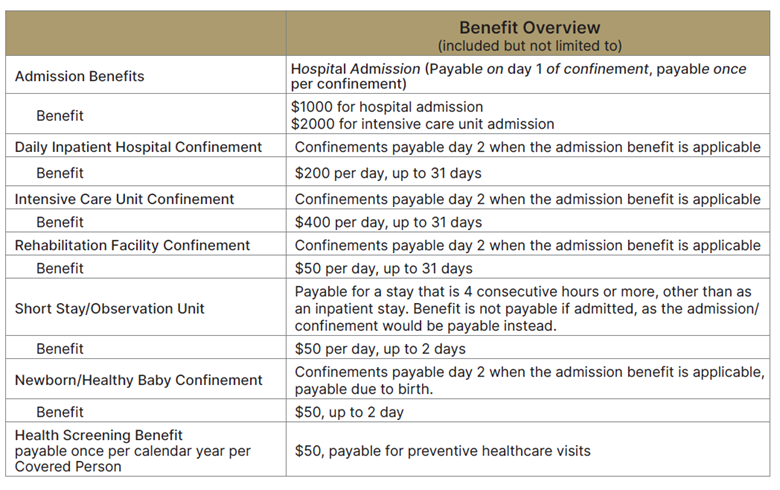

Hospital Indemnity insurance covers you and any enrolled dependent if you are admitted to the hospital or intensive care unit. The benefit pays a minimum cash lump sum of $1,000 if you are admitted to the hospital and pays a daily rate of at least $200 for each day you stay in the hospital. If you are admitted to the intensive care unit, the benefit doubles. Below is a summary of the benefits. For more information, please see the plan document.

Accident insurance

Accident insurance pays you a cash benefit if you or an enrolled dependent experiences a covered injury, such as a break, fracture, concussion, or dislocation, due to an accident. Below is a summary of the benefits. For more information, please see the plan document.

How to file a claim

Online

- Visit https://myNYLGBS.com (register if it’s your first time).

- Upload required documents (e.g., medical records or doctor’s notes).

- Set up direct deposit/Electronic Funds Transfer (EFT) for faster payment.

By phone

- Call 888.842.4462, (or 866.562.8241 Español), Monday- Friday, 7:00 a.m. – 7:00 p.m. C.T

By paper form

- Download and complete a claim form

- Submit your completed form using one of these methods:

-

Mail to:

New York LIfe Group Benefit Solutions

P.O. Box 709015

Dallas, TX 75370-9015 - Fax: (800) 642-8553

- Email: GBSIntakePaper@NewYorkLife.com

Resources

Critical Illness benefit summary

Hospital Indemnity benefit summary

Accident Insurance Benefit Summary